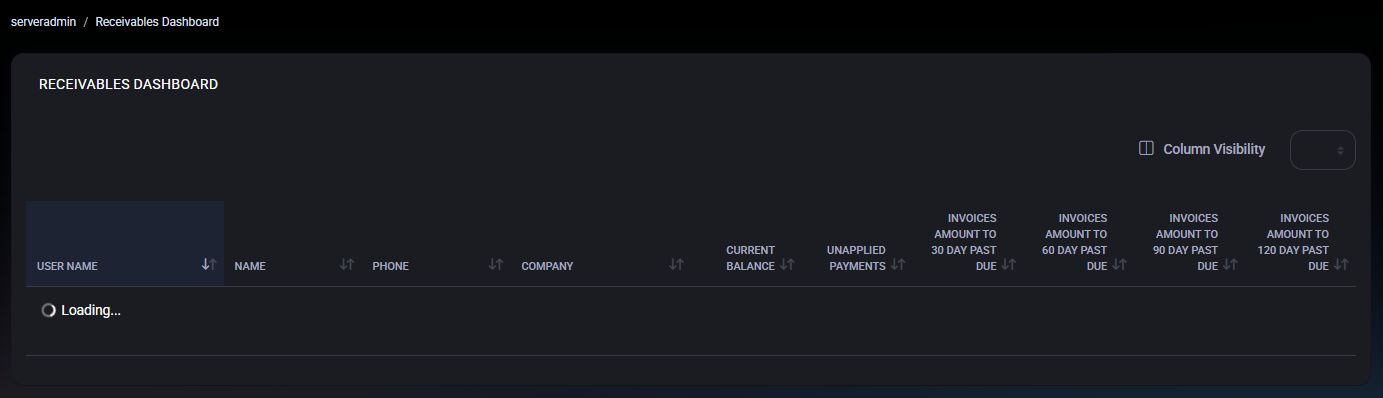

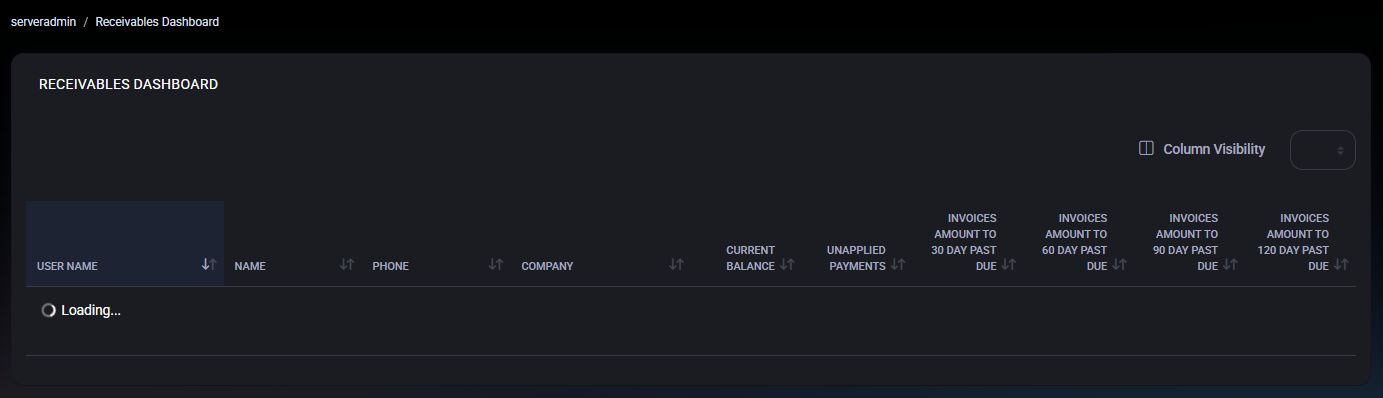

Receivables Dashboard

The Receivables Dashboard in MSPControl provides an at-a-glance overview of outstanding invoices and payment statuses for each customer. It helps administrators quickly identify overdue amounts, track unused payments, and manage billing more efficiently.

Overview

When you open the Receivables Dashboard, you’ll see a list of customers or users, along with key billing and contact details. Common columns include:

- User Name – The primary account or contact for the billing record.

- Phone – Contact phone number, allowing quick follow-up on overdue balances.

- Company – The organization or business name associated with the account.

- Unused Payment – Any credit or overpayment amount that hasn’t been applied to an invoice.

- Invoice Amount 0–30 Days – Total invoice amounts due within the last 30 days.

- Invoice Amount 31–60 Days – Amounts outstanding for invoices aged 31 to 60 days.

- Invoice Amount 61–90 Days – Amounts outstanding for invoices aged 61 to 90 days.

- Invoice Amount 91+ Days – Amounts outstanding for invoices over 90 days past due.

By consolidating this information, the dashboard gives you a snapshot of each customer’s financial status, highlighting overdue balances and unused payments that can be allocated.

Filtering and Sorting

At the top of the dashboard, you may find filters or a search bar to refine the displayed list.

For example:

- Customer – Select a specific customer or user group if you manage multiple clients.

- Search Field – Enter part of a company name, user name, or phone number to locate records.

You can also click column headers to sort by company, overdue amounts, or any other column.

This makes it easy to prioritize large overdue accounts or find a particular contact.

Detailed Customer Information

Clicking on a user name or company (depending on your MSPControl configuration) often leads to

more detailed billing or account information, such as:

- Invoice History – A list of all open and closed invoices, including payment dates and amounts.

- Payment Methods – Saved credit cards or other billing details for automated charges.

- Billing Settings – Options for invoice frequency, payment reminders, or dunning notices.

Best Practices

- Regularly Check Overdue Amounts – Focus on the 31–60, 61–90, and 91+ day columns to ensure timely follow-up on delinquent accounts.

- Apply Unused Payments Promptly – If a customer has credit (e.g., an overpayment), apply it to open invoices to keep records accurate and reduce outstanding balances.

- Use Sorting and Filtering – Sort by highest overdue amounts first or filter for specific customers to prioritize collection efforts efficiently.

- Update Contact Details – Ensure phone numbers and company names are up to date for smooth communication regarding overdue invoices.